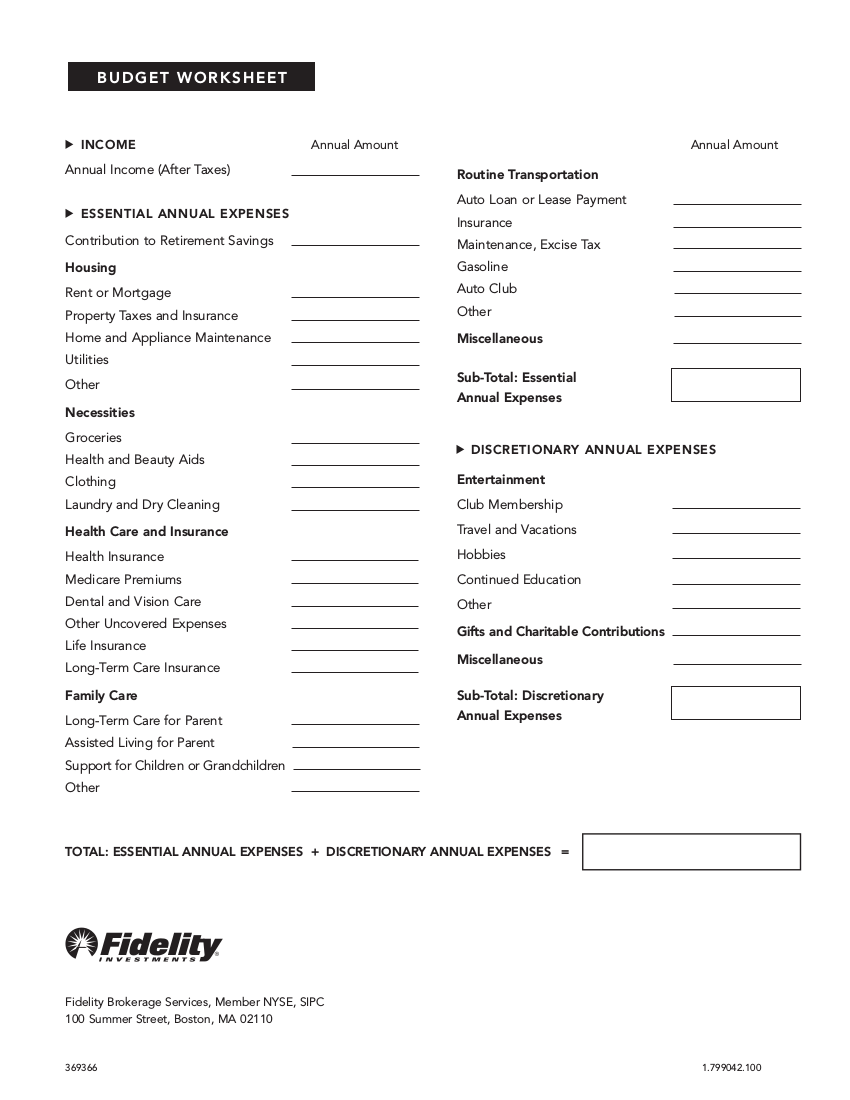

Fidelity Retirement Budget Worksheet Excel is a tool that can be utilized to assist people and families manage their finances and prepare for the future. It is a file that notes all of a person’s income and costs, and enables them to see where their money is going and recognize areas where they can cut costs or save more.

Creating a Fidelity Retirement Budget Worksheet Excel is a simple process that can be done using a spreadsheet program or perhaps on a notepad. The primary step is to note all of your earnings, including income, bonuses, and any other sources of income. Next, list all of your costs, consisting of lease or home loan payments, utility costs, groceries, and any other regular expenses. Deducting your costs from your earnings will give you a clear image of your overall monetary scenario and assist you figure out whether you are spending more than you are making.

Fidelity Retirement Budget Worksheet Excel

Once you have a clear picture of your earnings and costs, you can begin to make changes to your budget. If you discover that you are spending a lot of money on eating out, you may desire to think about preparing more meals at home. If you discover that you are spending a lot of cash on cable Television or streaming services, you might want to consider cutting back on these costs.

The Fidelity Retirement Budget Worksheet Excel can likewise be utilized to plan for long-lasting financial objectives such as saving for retirement or buying a house. By setting financial goals and creating a budget that enables you to conserve a particular quantity of money monthly, you can work towards attaining your goals.

Get Fidelity Retirement Budget Worksheet Excel

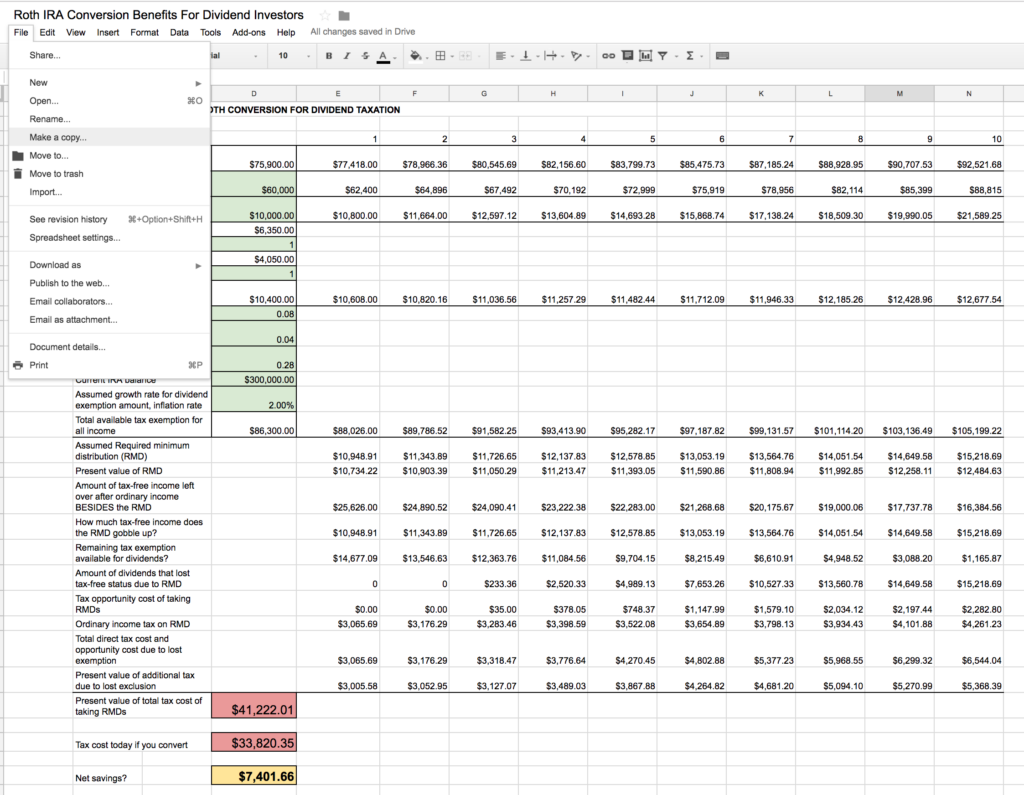

Roth IRA Conversion Spreadsheet Seeking Alpha

Using a Fidelity Retirement Budget Worksheet Excel can be a reliable way to take control of your financial resources and attain your financial goals. It allows you to see where your cash is going and make changes to your spending routines to enhance your financial situation. It can also be utilized to plan for future expenses, such as a holiday or a major purchase, which can help you to save money and avoid impulse buys.

Budget Worksheet 19 Examples Format Pdf Examples

It is necessary to evaluate the Fidelity Retirement Budget Worksheet Excel routinely, at least regular monthly, and change it appropriately. This will assist you to remain on track and make certain that you are on track to satisfy your monetary goals. It is also a great concept to get in the practice of routinely reviewing your budget, this will assist you to be more knowledgeable about your costs routines and make changes as required.

In general, Fidelity Retirement Budget Worksheet Excel is a powerful but easy tool that can assist you to take control of your financial resources and accomplish your monetary objectives. By keeping an eye on your earnings and expenditures, you can make changes to your spending practices and prepare for the future. It is vital to evaluate your budget worksheet routinely and change it appropriately, this will assist you to stay on track and reach your monetary objectives.