Budget For Saving is a tool that can be used to assist individuals and households manage their financial resources and plan for the future. It is a document that notes all of an individual’s income and costs, and permits them to see where their cash is going and determine locations where they can cut expenses or conserve more.

Creating a Budget For Saving is a basic procedure that can be done utilizing a spreadsheet program or even on a piece of paper. The primary step is to list all of your earnings, consisting of income, bonus offers, and any other income sources. Next, list all of your expenses, including rent or mortgage payments, energy costs, groceries, and any other routine expenditures. Subtracting your costs from your earnings will offer you a clear photo of your overall financial scenario and help you identify whether you are spending more than you are earning.

Budget For Saving

When you have a clear photo of your income and expenses, you can begin to make changes to your budget. For example, if you discover that you are spending a great deal of money on eating in restaurants, you might wish to consider cooking more meals at home. If you discover that you are spending a lot of money on cable Television or streaming services, you may want to consider cutting back on these costs.

The Budget For Saving can likewise be utilized to plan for long-lasting monetary objectives such as saving for retirement or buying a home. By setting monetary goals and developing a budget that permits you to conserve a particular amount of cash every month, you can work towards achieving your goals.

Get Budget For Saving

How To Save 10 000 00 In 52 Weeks Printable Savings Savingsplan Finances Financialtips How Money Saving Strategies Money Saving Plan Saving Money Budget

Utilizing a Budget For Saving can be an efficient method to take control of your finances and accomplish your monetary objectives. It permits you to see where your money is going and make changes to your costs practices to enhance your monetary scenario. It can likewise be utilized to plan for future expenditures, such as a holiday or a significant purchase, which can help you to conserve money and prevent impulse buys.

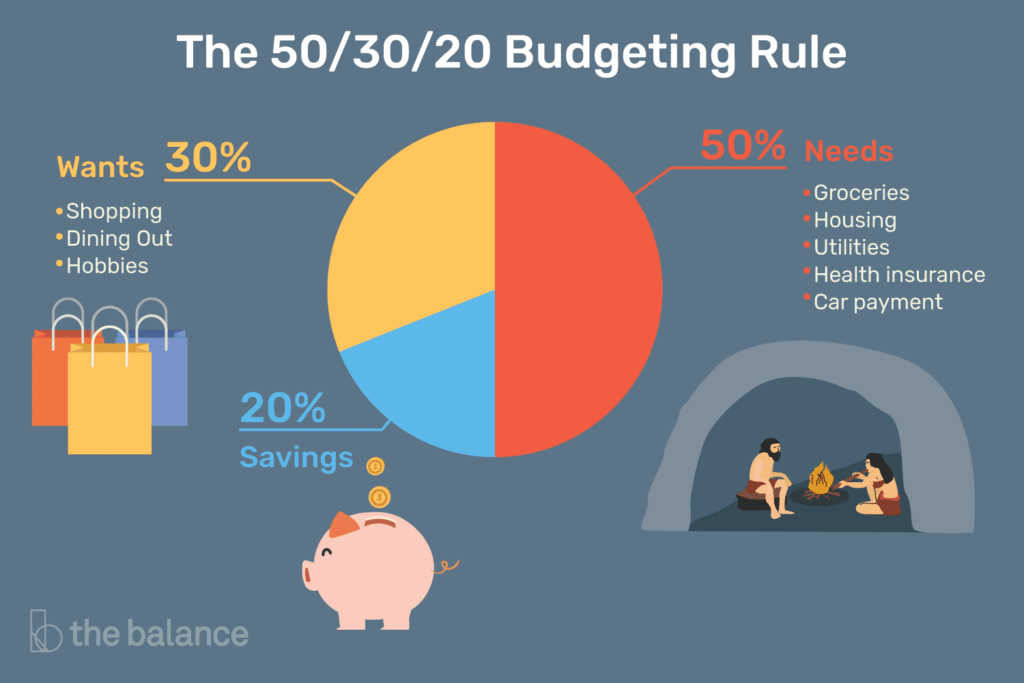

The 50 30 20 Rule Of Thumb For Budgeting

It is important to review the Budget For Saving regularly, at least monthly, and change it accordingly. This will assist you to remain on track and ensure that you are on track to fulfill your financial goals. It is also an excellent idea to get in the habit of regularly examining your budget, this will assist you to be more familiar with your spending habits and make changes as necessary.

In general, Budget For Saving is a powerful however easy tool that can help you to take control of your finances and attain your monetary objectives. By tracking your earnings and costs, you can make changes to your costs routines and plan for the future. It is vital to examine your budget worksheet frequently and adjust it accordingly, this will assist you to remain on track and reach your financial goals.