Budget Savings Plan is a tool that can be utilized to help individuals and homes handle their finances and plan for the future. It is a file that notes all of a person’s income and expenditures, and allows them to see where their money is going and determine locations where they can cut costs or conserve more.

Developing a Budget Savings Plan is a simple process that can be done using a spreadsheet program and even on a notepad. The initial step is to list all of your income, including income, rewards, and any other incomes. Next, list all of your expenses, including rent or mortgage payments, energy costs, groceries, and any other regular expenditures. Deducting your costs from your income will offer you a clear picture of your overall monetary circumstance and assist you identify whether you are investing more than you are making.

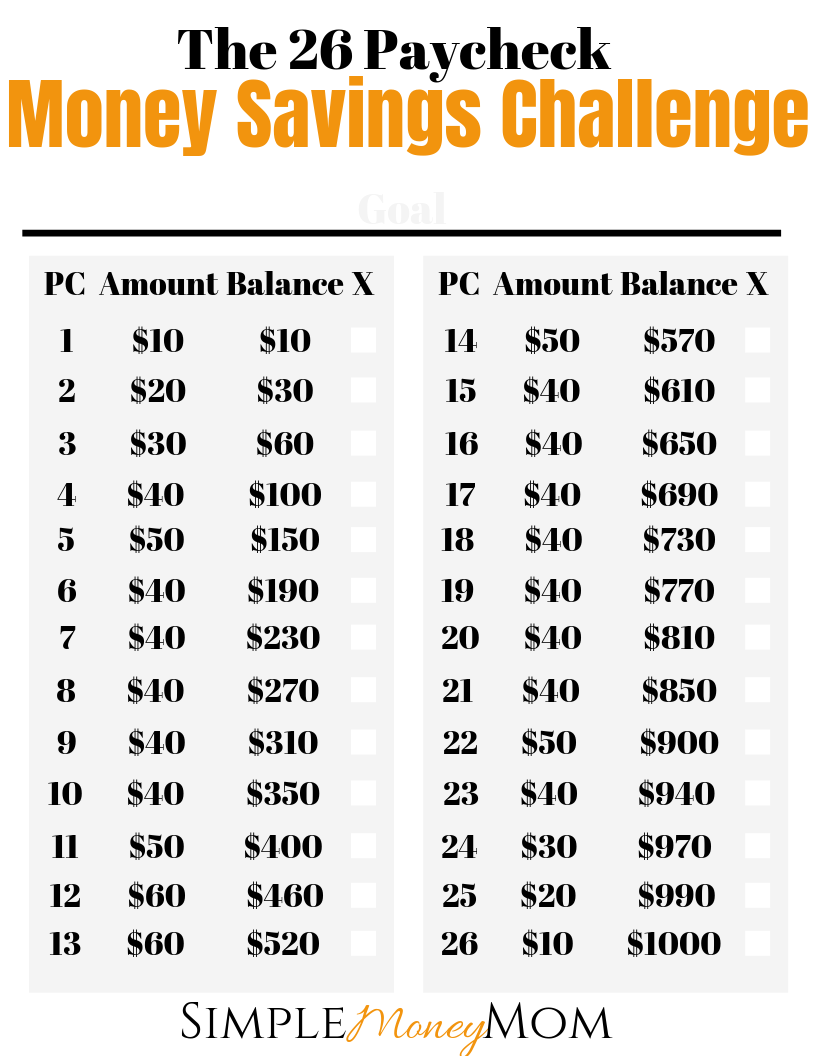

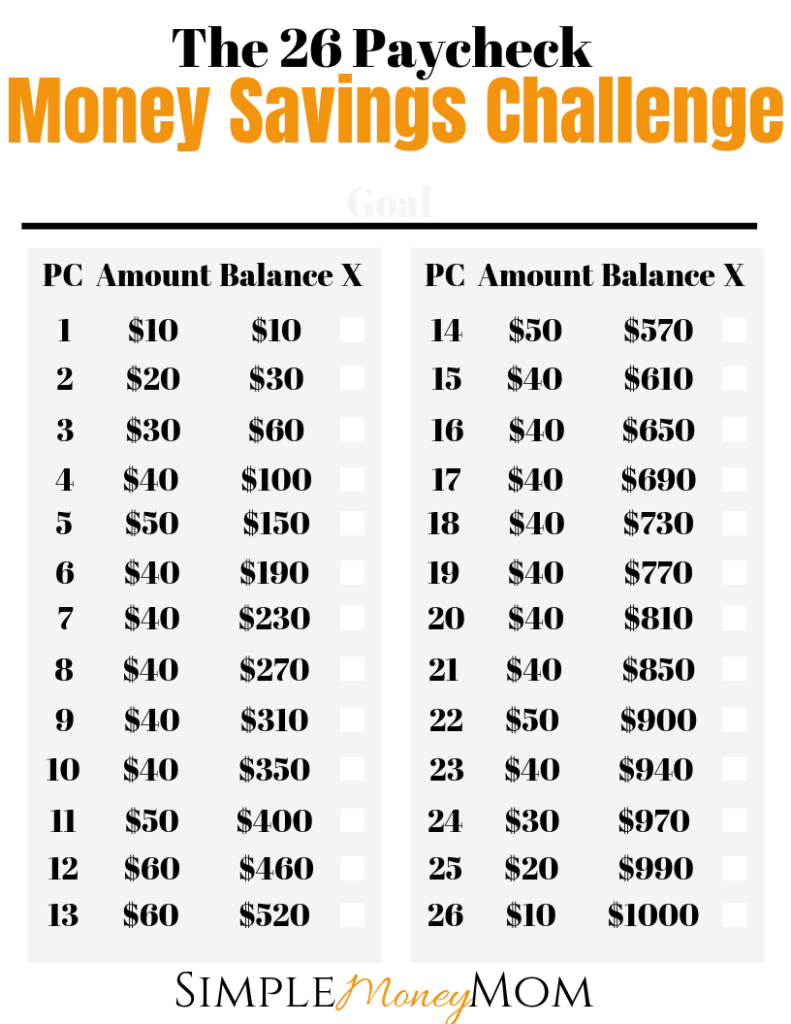

Budget Savings Plan

Once you have a clear image of your earnings and expenditures, you can begin to make changes to your budget. For example, if you find that you are investing a lot of money on eating in restaurants, you might wish to consider cooking more meals in your home. If you find that you are spending a lot of cash on cable television Television or streaming services, you may desire to consider cutting back on these expenditures.

The Budget Savings Plan can likewise be utilized to plan for long-term financial goals such as saving for retirement or buying a home. By setting financial goals and creating a budget that enables you to save a specific quantity of cash every month, you can work towards accomplishing your goals.

Get Budget Savings Plan

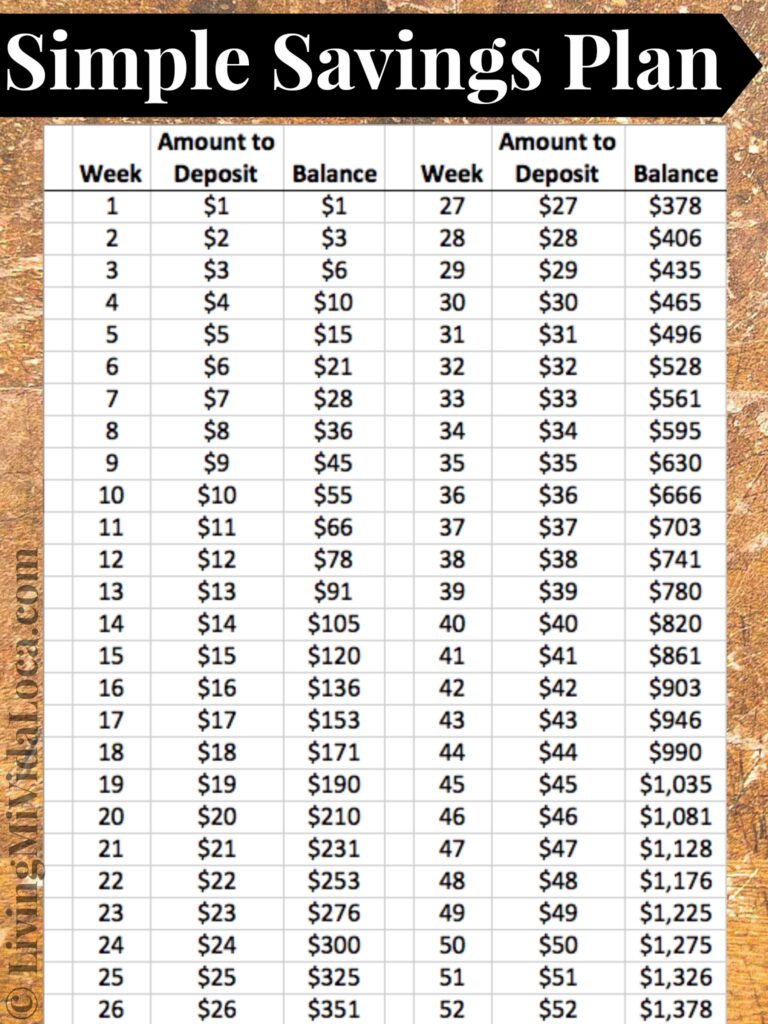

Save 1 300 A Year With This Weekly Savings Plan

Utilizing a Budget Savings Plan can be a reliable method to take control of your financial resources and accomplish your financial objectives. It allows you to see where your cash is going and make changes to your costs routines to enhance your financial circumstance. It can likewise be used to plan for future expenses, such as a holiday or a major purchase, which can assist you to save money and prevent impulse buys.

A Realistic Money Savings Challenge For Smaller Budgets Savings Challenge Money Saving Strategies Saving Money Budget

It is vital to review the Budget Savings Plan regularly, at least month-to-month, and change it appropriately. This will assist you to stay on track and ensure that you are on track to meet your monetary goals. It is also a good concept to get in the habit of frequently examining your budget, this will assist you to be more familiar with your spending routines and make modifications as essential.

Overall, Budget Savings Plan is a effective however easy tool that can assist you to take control of your finances and accomplish your financial objectives. By tracking your earnings and expenses, you can make changes to your costs habits and prepare for the future. It is necessary to review your budget worksheet regularly and change it appropriately, this will help you to stay on track and reach your monetary goals.