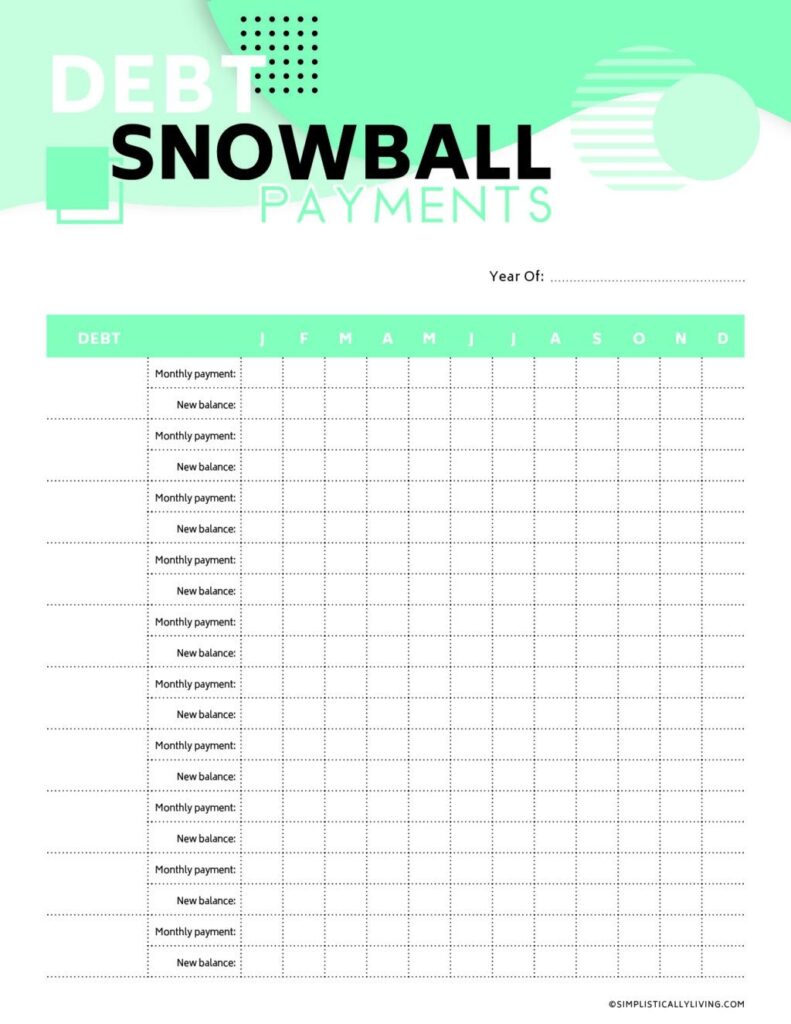

Pay Off Debt Budget Worksheet is a tool that can be utilized to assist individuals and families manage their financial resources and plan for the future. It is a document that notes all of a person’s earnings and costs, and allows them to see where their cash is going and recognize areas where they can cut costs or save more.

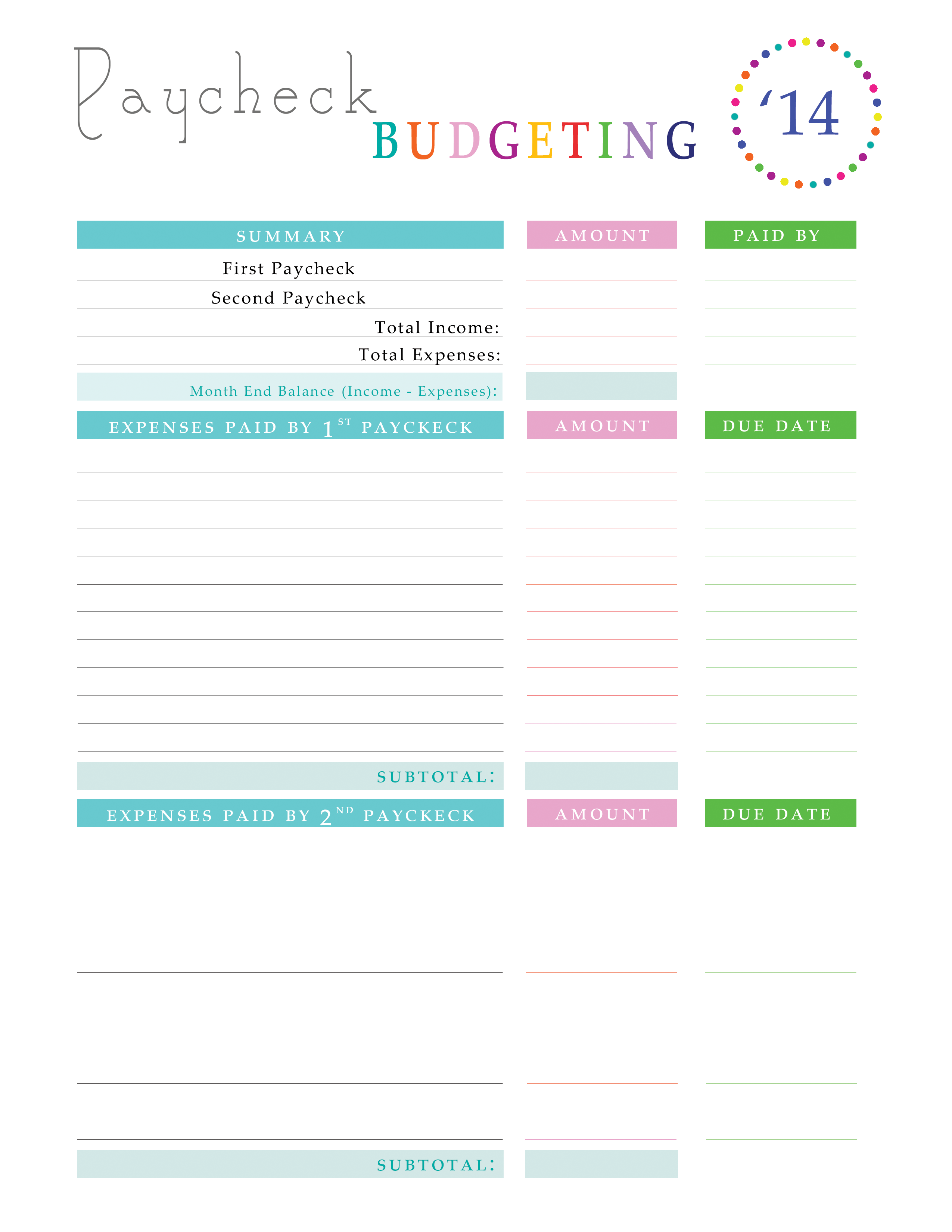

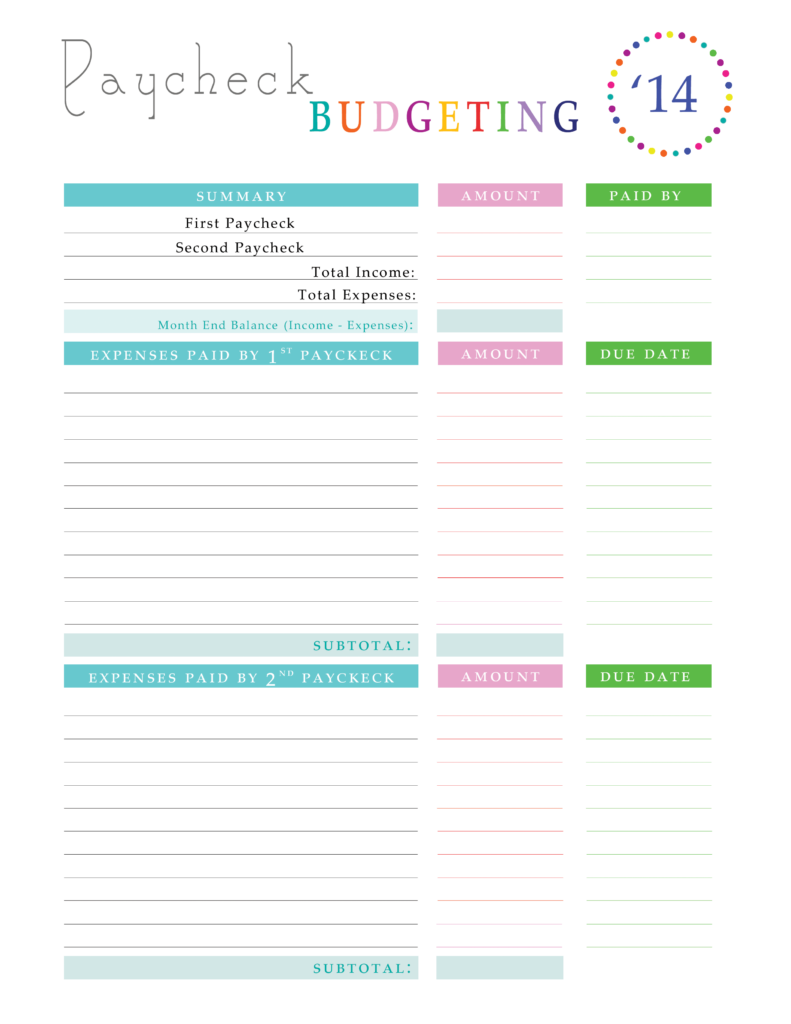

Producing a Pay Off Debt Budget Worksheet is an easy process that can be done using a spreadsheet program and even on a notepad. The first step is to note all of your income, including income, perks, and any other sources of income. Next, list all of your expenses, including rent or home mortgage payments, energy expenses, groceries, and any other routine costs. Subtracting your costs from your income will give you a clear image of your total monetary circumstance and assist you determine whether you are spending more than you are making.

Pay Off Debt Budget Worksheet

You can start to make changes to your budget as soon as you have a clear photo of your income and expenditures. If you discover that you are investing a lot of cash on eating out, you might desire to think about cooking more meals at home. Likewise, if you discover that you are investing a lot of cash on cable or streaming services, you may want to consider cutting back on these expenditures.

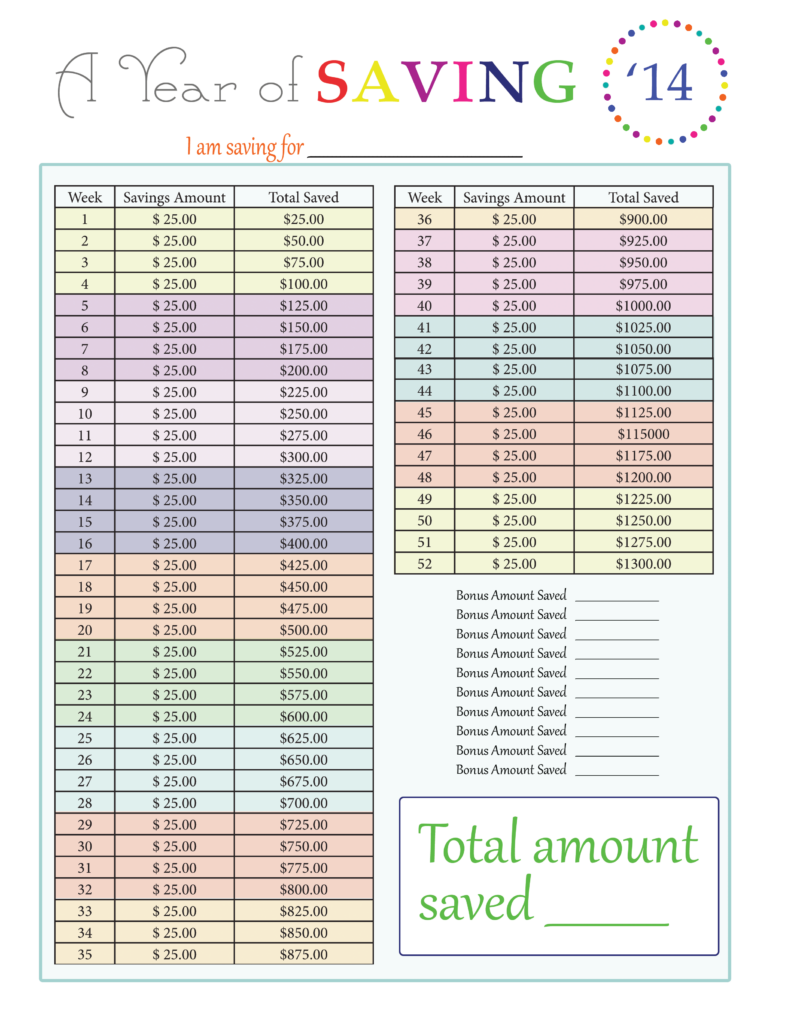

The Pay Off Debt Budget Worksheet can likewise be used to plan for long-term monetary goals such as saving for retirement or buying a home. By setting monetary objectives and producing a budget that enables you to conserve a certain amount of money every month, you can work towards achieving your objectives.

Get Pay Off Debt Budget Worksheet

Paying Off Debt Worksheets

Utilizing a Pay Off Debt Budget Worksheet can be an effective method to take control of your finances and achieve your financial objectives. It enables you to see where your money is going and make changes to your spending routines to improve your financial scenario. It can also be utilized to prepare for future expenses, such as a holiday or a significant purchase, which can help you to save cash and prevent impulse buys.

Paying Off Debt Worksheets Budgeting Budget Planner Template Budget Planner

It is vital to evaluate the Pay Off Debt Budget Worksheet frequently, at least monthly, and adjust it appropriately. This will help you to remain on track and ensure that you are on track to fulfill your financial objectives. It is also a good idea to get in the practice of routinely examining your budget, this will assist you to be more aware of your costs routines and make changes as essential.

Overall, Pay Off Debt Budget Worksheet is a effective but simple tool that can help you to take control of your finances and accomplish your financial objectives. By monitoring your earnings and expenditures, you can make changes to your spending practices and prepare for the future. It is vital to examine your budget worksheet routinely and adjust it appropriately, this will assist you to remain on track and reach your monetary goals.